Article Analysis:

3 Highlights:

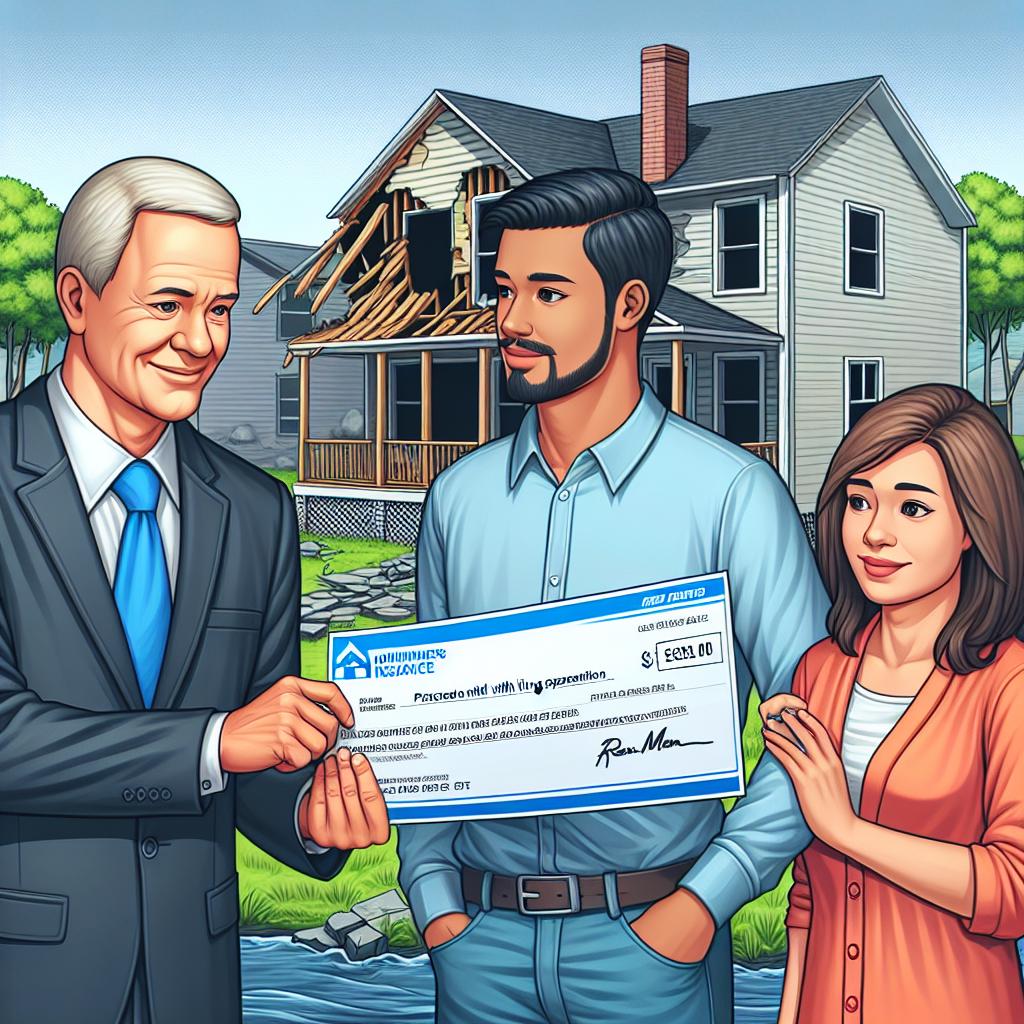

1. The article discusses how homeowners or renters insurance policies may include provisions for coverage of new lodging and living expenses in case of a natural disaster.

2. It mentions significant estimated insured losses from recent hurricanes, such as Hurricane Helene and Hurricane Milton, ranging from $17.5 billion to $60 billion.

3. Experts emphasize the importance of understanding and utilizing the “loss of use” or “additional living expenses” coverage provided by insurance companies after a disaster strikes.

Summary:

The article highlights the importance of homeowners and renters being aware of the provisions in their insurance policies that can help cover living expenses if their home becomes uninhabitable due to a natural disaster. It stresses the necessity of communicating with insurance companies about the “loss of use” coverage and the process of filing claims promptly to receive financial assistance for temporary housing and other expenses. Additionally, it notes the limitations of such coverage as a short-term solution and advises individuals to also seek aid from organizations like FEMA for long-term recovery after major disasters.

Editorial content by Blake Sterling