##Highlights of the Article:

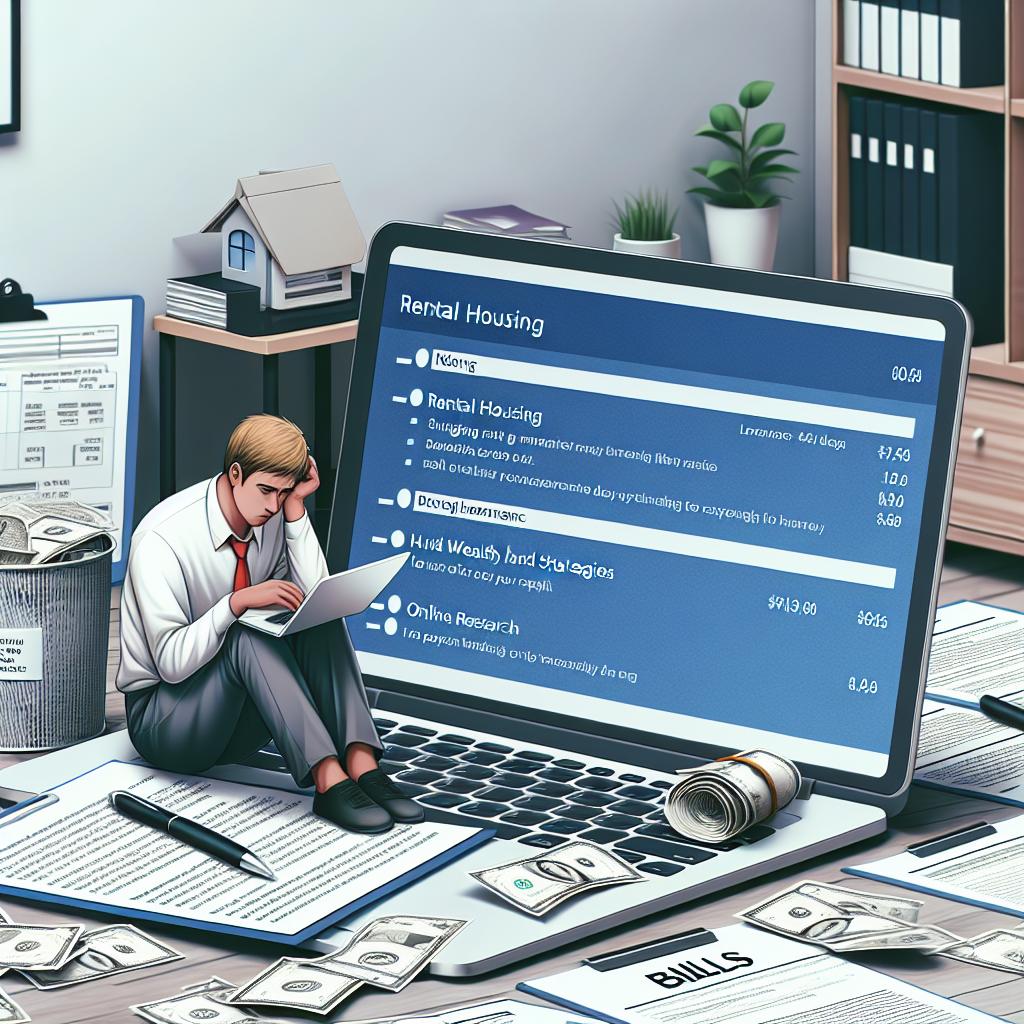

1. Median Net Worth: The article highlights that in 2022, the typical renter in the U.S. had a median net worth of $10,400, which is a record high but still significantly lower than the nearly $400,000 net worth of homeowners.

2. Factors Affecting Renters’ Finances: Renters face financial challenges such as lower income, higher debt, and lower rates of asset ownership compared to homeowners.

3. Building Wealth for Renters: Steps renters can take to build wealth include paying off outstanding debt, increasing income and savings, and assessing the possibility of home ownership.

##Summary of the Article:

The article discusses the financial disparities between renters and homeowners in the U.S., with renters facing challenges such as lower net worth, income, savings, and asset ownership. It provides insights from a report by the Aspen Institute on how renters across different income brackets can improve their financial standing and build wealth.

##Opinion:

The article sheds light on an important issue of financial inequality between renters and homeowners. It emphasizes the need for renters to focus on strategies to increase their income, savings, and overall financial stability. It’s crucial for policymakers and financial advisors to address these disparities and provide resources to help renters improve their financial well-being. Encouraging steps like paying off debts and exploring options for home ownership can empower renters to build a more secure financial future.

Editorial content by Blake Sterling