##Highlights of the Article:

1. The Federal Reserve is expected to lower interest rates by another quarter point, marking the third rate cut in a row, with a total reduction of one percentage point since September.

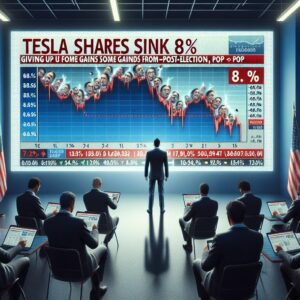

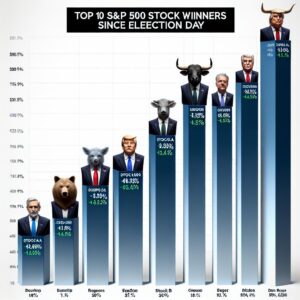

2. There is uncertainty around the Fed’s future decisions due to the upcoming fiscal policies of President-elect Donald Trump.

3. The article explains how interest rate changes by the Fed impact various consumer borrowing costs, such as credit cards, mortgages, auto loans, student loans, and savings rates.

##Summary:

The article discusses the Federal Reserve’s expected interest rate cut, the impact of this decision on consumer borrowing costs, and the uncertainty surrounding future rate adjustments due to potential changes in fiscal policy. It provides insights into how different types of loans, including credit cards, mortgages, auto loans, and student loans, are affected by interest rate fluctuations.

##Opinion:

The article offers valuable information on how consumers are influenced by the Federal Reserve’s interest rate decisions, shedding light on the dynamics of borrowing costs for various types of loans. Understanding these impacts can help individuals make informed financial decisions and adapt to changing economic conditions. Keeping track of such updates is crucial for anyone managing debt or savings, as it provides insight into how their financial landscape may shift in response to macroeconomic changes.

Editorial content by Jordan Fields