Highlights:

– More than 200,000 private companies in India have shut down in the last five years.

– Concerns are rising regarding shell companies and their potential roles in financial misconduct.

– The government emphasizes efforts to simplify tax regulations to boost investment.

Introduction to Corporate Closures in India

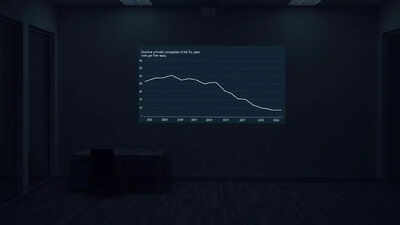

In a significant revelation, the Indian government disclosed that over 200,000 private companies have been dissolved in the country from 2020 to 2025. This alarming statistic raises questions about the economic health of the private sector and the potential consequences for both employees and the overall market. Minister of State for Corporate Affairs, Harsh Malhotra, provided this data in a written response to the Lok Sabha, highlighting a concerning trend in corporate sustainability and the effectiveness of existing regulations.

The closure of such a vast number of companies can indicate deeper issues within the economic framework, including difficulties in operational viability, the impact of regulatory frameworks, and changing market dynamics. Understanding these closures matters not just for policymakers but also for employees and entrepreneurs navigating an uncertain business landscape.

Exploring the Reasons Behind the Closures

According to the reports, a total of 204,268 companies were terminated for various reasons, including amalgamation, conversion, and dissolution, as well as removal from official records under the Companies Act, 2013. Furthermore, it was revealed that 185,350 companies were officially deregistered during this period, underscoring the scale of corporate disintegration. This raises critical concerns about job security for those employed in these entities. Unfortunately, the government currently has no plans to rehabilitate those displaced workers, leaving many without clear avenues for support or recovery.

In addressing the ongoing issues with shell companies, Minister Malhotra pointed out that these entities are not well defined within the legal framework. Nonetheless, suspicions surrounding their potential misuse, such as in money laundering activities, prompt monitoring by various government agencies, including the Enforcement Directorate and the Income Tax Department. This oversight emphasizes the importance of maintaining robust controls to prevent misuse of the corporate registration process while ensuring that legitimate businesses can thrive.

The Broader Implications and Path Forward

The implications of these statistics are profound. The government has acknowledged that it is crucial to simplify and rationalize the tax framework to create a conducive environment for businesses to flourish. Reducing corporate tax rates is part of a broader strategy aimed at encouraging domestic investment and enhancing the ease of doing business within India. Such reforms can be a double-edged sword, improving competitiveness but also potentially leading to further closures if not executed prudently.

As discussions continue regarding the fate of those employees affected by the closures, the government’s commitment to reforming regulatory measures will be pivotal. The solution lies not only in addressing the bureaucratic hurdles that lead to company closures but also in implementing supportive programs for displaced workers. How effectively the government balances regulatory rigor with support for businesses and workers could shape the future landscape of the Indian economy.

In conclusion, the closure of over 200,000 private companies highlights critical vulnerabilities within the corporate sector and the importance of responsive regulatory frameworks. As we reflect on these developments, consider these questions: What measures should the government implement to support the employees of closed companies? How can businesses adapt to changing regulations and market conditions to ensure longevity? What role should corporate governance play in preventing future closures?

Editorial content by Jordan Fields